VMS TMT IPO 2025: Check IPO Date, Price Range and Lot Size

Let us understand the important aspects related to the VMS TMT IPO. First, let us see the basics about VMS TMT:

Founded in 2013, VMS TMT Ltd. manufactures Thermo Mechanically Treated (TMT) Bars.

Its operations are focused in Gujarat (except Saurashtra & Kutch districts), selling through 3 distributors and 227 dealers as of July 2025.

The company emphasises sustainability, quality, environment, health & safety, and uses renewable energy and in-house raw material production to manage costs.

VMS TMT IPO Details 2025

The following are some of the important financial details of VMS TMT IPO:

VMS TMT IPO Market Lot

The following table provides information about the VMS TMT IPO market lot:

VMS TMT IPO Dates

The following are the important dates related to VMS TMT IPO:

VMS TMT Financial Report

The following table shows the financial report of VMS TMT Ltd (in ₹ crore):

VMS TMT Key Ratios and Metrics

The following table shows some key metrics and their values for VMS TMT Ltd:

Promoters of VMS TMT IPO

VMS TMT IPO is promoted by Varun Manojkumar Jain; Rishabh Sunil Singhi; Manojkumar Jain; Sangeeta Jain.

Lead Managers (Merchant Bankers) for VMS TMT IPO

The following are the lead managers (also known as Merchant Bankers) for VMS TMT IPO:

- Arihant Capital Markets Ltd.

VMS TMT IPO Registrar

The following is the VMS TMT IPO registrar details:

KFin Technologies Limited:

- Phone: 04067162222, 04079611000

- Email: vtl.ipo@kfintech.com

- Website: https://ipostatus.kfintech.com/

VMS TMT Company Address:

The following is the company address for VMS TMT:

VMS TMT Ltd.

- Address: Survey No. 214 Bhayla Village, Near Water Tank Bavla, Ahmedabad, Gujarat, 382220

- Phone: +91 63575 85711

- Email: compliance@vmstmt.com

- Website: http://www.vmstmt.com/

Frequently Asked Questions - VMS TMT IPO

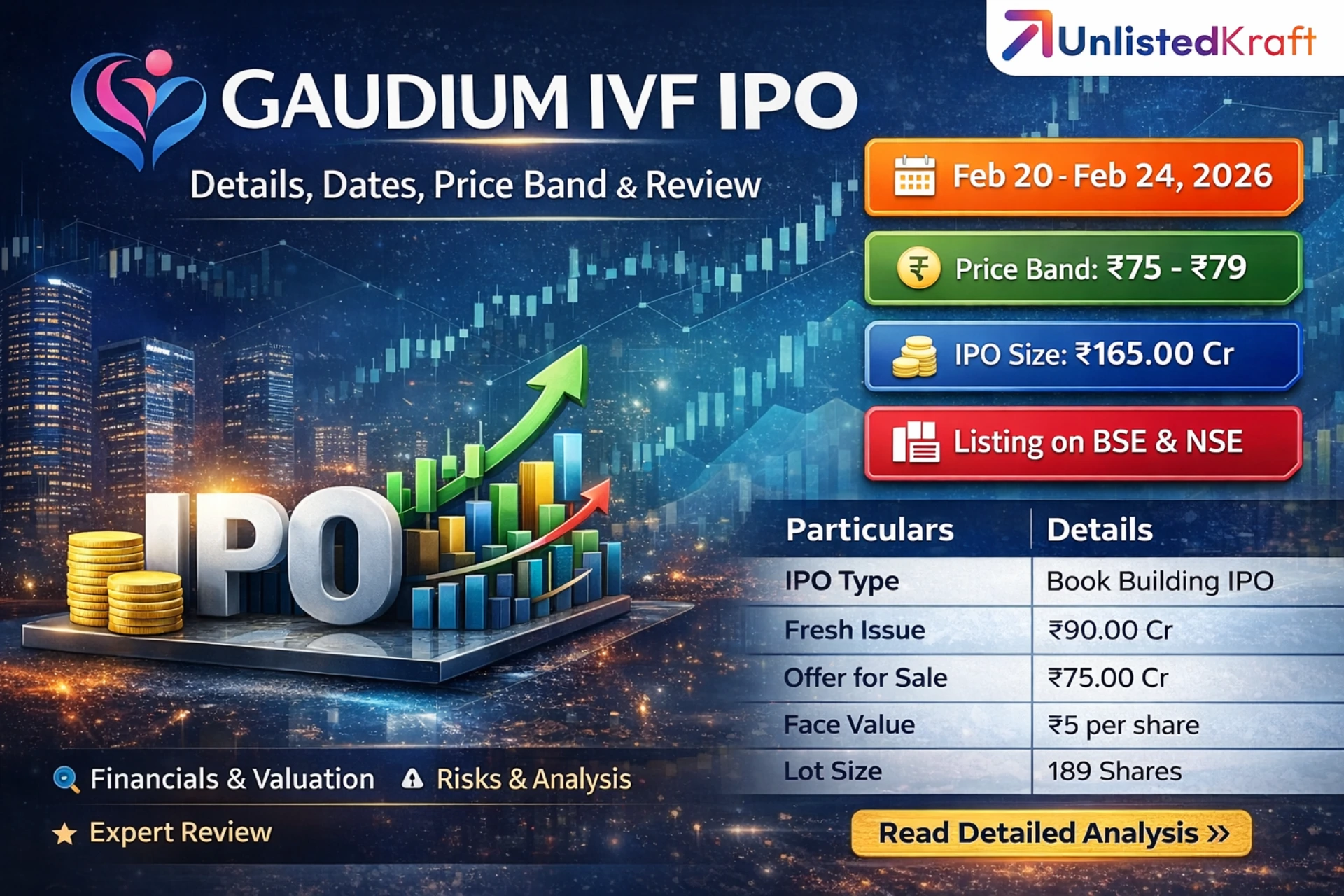

What is VMS TMT IPO?

VMS TMT IPO is a Mainbaord IPO. The company is going to raise ₹148.50 Crores via IPO. The issue is priced at ₹94 to ₹99 per equity share. The IPO is to be listed on BSE & NSE.

When VMS TMT IPO will open for subscription?

The IPO is to open on September 17, 2025 for QIB, NII, and Retail Investors. The IPO will close on September 19, 2025.

What is VMS TMT IPO Investors Portion?

The investors’ portion for QIB is 30%, NII is 20%, and Retail is 50%.

How to Apply the VMS TMT IPO?

You can apply for VMS TMT IPO via ASBA online via your bank account. You can also apply for ASBA online via UPI through your stock brokers. You can also apply via your stock brokers by filling up the offline form.

What is VMS TMT IPO Issue Size?

VMS TMT IPO issue size is ₹148.50 crores.

What is VMS TMT IPO Price Band?

VMS TMT IPO Price Band is ₹94 to ₹99.

What is VMS TMT IPO Lot Size?

The minimum bid is 150 Shares with ₹14,850 amount.

What is the VMS TMT IPO Allotment Date?

VMS TMT IPO allotment date is September 22, 2025.

What is the VMS TMT IPO Listing Date?

VMS TMT IPO listing date is September 24, 2025. The IPO is to list on BSE & NSE.

Important Disclaimer: UnlistedKraft strive to provide the most up-to-date and accurate IPO details. However, details may change due to regulatory or market developments. Please verify key information before investing.

Diwakar Kumar Singh is a finance writer and BFSI specialist with 7+ years of experience in financial content and research. He has authored hundreds of finance articles, published multiple books internationally, and contributed to research publications. A Gold Medalist MBA from IMT, he brings a strong analytical understanding combined with clear, reader-focused communication. His work focuses on simplifying complex financial topics, including IPO analysis, unlisted shares, financial ratios, and company evaluations, providing well-researched and evidence-based insights to help readers make informed financial decisions.

Enquiry for Unlisted Shares

Related Post

Reach out to our Experts if you have any Doubts

Like the best things in life, Consultations @Unlistedkraft are free

Drop a Mail or give us a Missed Call & Begin your Investment Journey here

.webp)