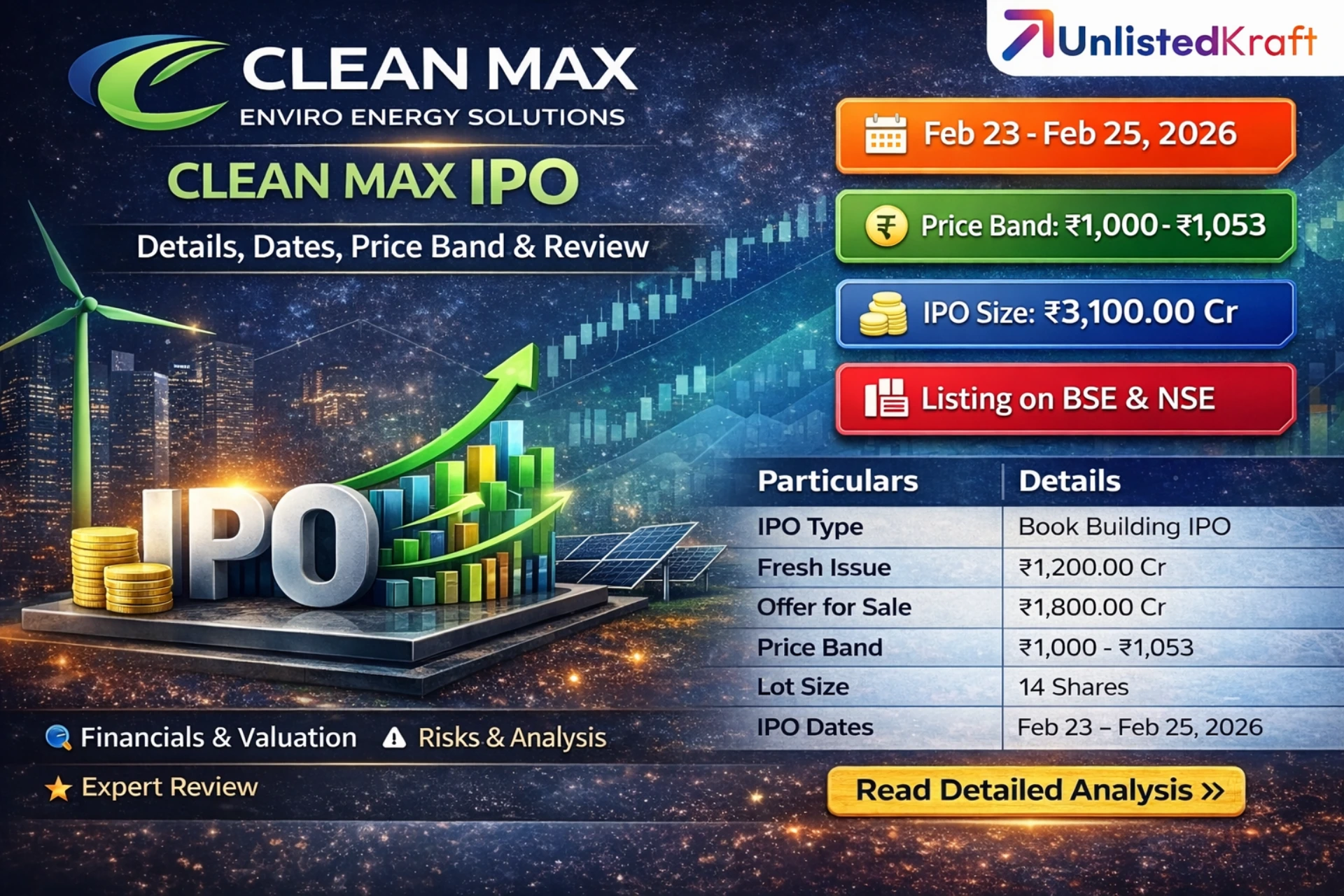

Corona Remedies IPO Dec 2025: GMP, Price Band, Dates & Full Review

Corona Remedies IPO is a ₹655.37 crore book-built issue, offered entirely through an Offer for Sale. This means the company will not receive any new funds. Instead, existing shareholders are selling a part of their stake. The company operates in the pharmaceutical segment with strong brands across women’s healthcare, cardio-diabeto, urology, pain management, and multispecialty therapies.

The IPO opens for subscription on December 8, 2025, and closes on December 10, 2025, with listing expected on December 15, 2025.

In this detailed guide, we will break down every important detail of the Corona Remedies IPO — including fundamentals, financials, valuation, and whether it is worth applying or not.

Let’s understand everything step-by-step so that you can make an informed investment decision.

Corona Remedies IPO Key Details 2025

Corona Remedies IPO Key Details 2025

The following are some of the important and key details about Corona Remedies IPO.

Corona Remedies IPO Reservation Structure

Corona Remedies IPO Reservation Structure

This section shows how shares are divided among investor categories.

Corona Remedies IPO Application Limits

Corona Remedies IPO Application Limits

These are the bidding limits according to investor type:

Corona Remedies IPO Timeline

Corona Remedies IPO Timeline

This table shows all key dates related to the IPO:

Corona Remedies IPO Lot Size

Corona Remedies IPO Lot Size

The following table explains the minimum and maximum investment limits:

Corona Remedies Promoter Holding

Corona Remedies Promoter Holding

This table shows shareholding changes before and after IPO:

About Corona Remedies Business Operations

About Corona Remedies Business Operations

Corona Remedies Ltd., incorporated in 2004, is a fast-growing Indian pharmaceutical company with a strong portfolio covering multiple therapeutic categories.

The company markets 71 brands across women’s healthcare, cardio-diabetic care, gastrointestinal drugs, respiratory products, nutrition supplements, and more. The company has:

- 2 manufacturing facilities in Gujarat

- 1,285.44 million units per annum installed capacity

- 2,671 medical representatives across 22 states

- Strong focus on "middle of the pyramid" affordable Indian healthcare segment

The company is the second fastest-growing pharma company in the top 30 league (MAT June 2022–MAT June 2025).

Corona Remedies Competitive Strengths

Corona Remedies Competitive Strengths

Below are the major competitive advantages of Corona Remedies Ltd.

- Strong growth momentum in the Indian pharma market.

- Wide portfolio of high-performing “engine brands.”

- Pan-India distribution with deep doctor-connect.

- Good manufacturing practices with strong R&D capabilities.

- Low debt and strong profitability.

- Well-experienced management team with marquee investors.

Corona Remedies Financials

Corona Remedies Financials

This section provides a snapshot of the company’s historical financial performance.

Corona Remedies Ltd. Financial Information (₹ in Crore)

Key Highlights:

- Revenue grew 18% YoY (FY25 over FY24).

- Profit jumped 65% YoY, showing strong margin improvement.

- Debt remains very low, indicating a healthy balance sheet.

- Consistent cash generation and strong reserves.

Key Performance Indicators

This section highlights the company’s profitability and efficiency ratios.

Corona Remedies Valuation

Below is a quick valuation comparison based on EPS and P/E.

The valuation appears premium but justified, considering strong growth, profitability, and brand strength.

15-Point Detailed Corona Remedies IPO Analysis

15-Point Detailed Corona Remedies IPO Analysis

This section explains all major factors that investors should evaluate.

- Company Overview: Corona Remedies is a fast-growing Indian pharma company with a wide multi-therapy presence.

- Business Model: The company develops, manufactures, and markets branded pharmaceutical products.

- Financial Performance: Revenues and profits show strong growth, with consistent margins and low debt.

- Industry Outlook: Indian pharma is expected to grow steadily due to rising healthcare needs.

- IPO Structure: The IPO is 100% OFS, meaning no new capital is raised for growth.

- Use of Funds: No fresh funds; only existing shareholders are selling their stake.

- Promoters & Management: Experienced leadership with decades of pharma expertise.

- Market Potential: Strong demand in women’s healthcare, cardio, and chronic segments.

- Competitive Position: Ranks among the fastest-growing top 30 pharma companies.

- Risks: High dependence on domestic markets, regulatory risks, and pricing pressure.

- Debt Position: Very low debt; healthy balance sheet.

- Profitability: Strong EBITDA and PAT margins, improving every year.

- Valuation: Premium, but supported by growth and margins.

- Shareholder Dilution: No dilution since it is an OFS.

- Overall Outlook: Ideal for long-term investors looking for a strong pharma growth story.

Corona Remedies Promoters Table

Corona Remedies Promoters Table

Below is the list of promoters for Corona Remedies Ltd.:

- Dr. Kirtikumar Laxmidas Mehta

- Niravkumar Kirtikumar Mehta

- Ankur Kirtikumar Mehta

Conclusion

Conclusion

Corona Remedies Ltd. is a strong player in the Indian branded formulations market with a growing portfolio, strong distribution network, strong margins, and low debt. The financial performance is solid, and the company is positioned well for long-term growth.

However, since it is a full OFS, investors should weigh valuation and market conditions before applying.

Frequently Asked Questions

Frequently Asked Questions

What is the Corona Remedies Ltd. IPO?

It is a ₹655.37 crore book-built IPO, fully through an Offer for Sale.

When does the Corona Remedies Ltd. IPO open?

The IPO opens on December 8, 2025.

What is the price band for the Corona Remedies Ltd. IPO?

The price band is ₹1008 to ₹1062 per share.

How much is the minimum investment in the Corona Remedies Ltd. IPO?

Retail investors must invest at least ₹14,868 for one lot.

Is there any fresh issue in the Corona Remedies Ltd. IPO?

No. This IPO consists entirely of an OFS.

Does Corona Remedies Ltd. offer an employee discount?

Yes, employees get a ₹54 per share discount.

When will the allotment for the Corona Remedies Ltd. IPO be announced?

Allotment is expected on December 11, 2025.

What is the listing date of Corona Remedies Ltd. IPO?

The tentative listing date is December 15, 2025.

How is the financial performance of Corona Remedies Ltd.?

The company has shown strong revenue growth, rising profits, and low debt.

Should investors apply for the Corona Remedies Ltd. IPO?

It may suit investors seeking a strong pharma business with growth momentum, but valuation should be considered carefully.

Diwakar Kumar Singh is a finance writer and BFSI specialist with 7+ years of experience in financial content and research. He has authored hundreds of finance articles, published multiple books internationally, and contributed to research publications. A Gold Medalist MBA from IMT, he brings a strong analytical understanding combined with clear, reader-focused communication. His work focuses on simplifying complex financial topics, including IPO analysis, unlisted shares, financial ratios, and company evaluations, providing well-researched and evidence-based insights to help readers make informed financial decisions.

Enquiry for Unlisted Shares

Related Post

Reach out to our Experts if you have any Doubts

Like the best things in life, Consultations @Unlistedkraft are free

Drop a Mail or give us a Missed Call & Begin your Investment Journey here

.webp)